Good Corporate Governance (GCG)

Good Corporate Government (GCG) is one of the main pillars that sustain the operations of a company as well as a key indicator of accountability. PNM has a firm commitment to GCG implementation.

PNM is fully aware that GCG implementation will help achieve the mission of providing the best service to all stakeholders. For PNM, the implementation of GCG is not merely a formality. PNM's commitment to implementing GCG is outlined in the PNM Management System (SM PNM) to ensure the consistency of GCG implementation in the corporate environment as a whole by involving all levels and management tools of the company management.

SM PNM provides measurable and accountable direction for all aspects of GCG implementation and concepts and implementation of ISO 9001: 2008 Quality Management System, Balance Score Card (BSC) and other organizational tools. SM PNM is also based on values and corporate culture. The BSC implementation in PNM focuses on several aspects of corporate organizations such as finance, business processes, HR optimization, and stakeholders.

To maintain the consistency of GCG implementation, companies regularly and programmatically continue to conduct comprehensive studies and evaluations of various aspects of their operations, including studies on supporting business organizations. This study and evaluation will be followed by operational improvements and the company's business in order to be able to meet and satisfy customer needs and expectations for quality services through the output of high quality and competitive products so that they can be well received by the market.

The company's GCG implementation also includes risk management and control to guarantee the company's ability. Another study that is regularly carried out by companies in the evaluation of the completeness of the organizational structure, including the cost and benefit aspects.

PNM Management is committed to realizing good corporate governance based on the principles of openness, independence, accountability, fairness, and accountability in every activity. The practice of Good Corporate Governance is very important to ensure the achievement of sustainable growth.

In addition, Good Corporate Governance can also build a company image and maintain business ethics and compliance with existing regulations so as to provide benefits to all stakeholders.

In order to implement good governance, the PNM Board of Directors has established the Board of Directors' Guidelines and Work Procedures (BOD Charter) for the implementation of its duties and responsibilities. Likewise, in the implementation of the Company's supervisory duties and functions by the Board of Commissioners, it refers to the Board of Commissioners' Guidelines and Work Procedures (Board Charter). This serves as a reference for the Board of Commissioners and the Board of Directors in carrying out their duties and responsibilities in managing the company in accordance with the principles of openness, accountability, responsibility, independence, justice and fairness, as well as complying with applicable laws and regulations. In carrying out its duties, the PNM Board of Directors refers to the BOD Charter as stated in SK-139/PNM-DIR/XII/23. Meanwhile, the Board of Commissioners refers to the BOC Charter as stated in SK-014/PNM-KOM/XII/23.

These work guidelines can be reviewed to comply with POJK number 16/POJK.05/2019 which applies to the supervision of PT PNM.

SK-136/PNM-DIR/XII/23 serves as the basis for implementing risk management guidelines within the company's work environment. This is implemented to achieve good corporate governance , necessitating effective risk management.

The implementation of risk management is crucial for a company to enhance its ability to navigate uncertainties and changes in its business environment. Decision-makers within the company are also crucial in implementing risk management, ensuring reasonable assurance regarding decisions made and optimally and effectively allocating company resources. This also enhances stakeholder trust in the company. All units within the company must have a clear understanding of their roles, responsibilities, and authority in implementing risk management within the company.

The PNM Risk Management Implementation Guidelines are based on document number PNM/PK-0004 Revision 0.2 dated September 7, 2022. As a basis for the behavior of all PNM Personnel, in realizing Risk Management practices in carrying out their duties and responsibilities, which support the Company's business and operations in accordance with AKHLAK behavior. PNM Personnel must participate in building an optimal and robust Company Risk Management system so as to shape the resilience and sustainability of the Company's business. Dare to take risks with full responsibility in a measured manner based on reliability in controlling and managing Company risks while still paying attention to and referring to the risk appetite and tolerance that has been determined by the Board of Directors. Realize various value creation opportunities, for the Company and stakeholders in a balanced manner, through the development of internal capabilities to carry out all functions reliably, while still prioritizing compliance and business ethics.

The Risk Management Policy must be implemented by all organizational elements, including the Board of Commissioners, Directors, management, and all PNM employees. The guidelines must also be updated whenever changes occur to external or internal regulations that impact the content of the guidelines. The Risk Management Implementation Guidelines cover the organization and function of risk management, policies and limit setting, risk management implementation, risk management processes, business development/expansion, risk management information systems, emergency plans, risk profiles, and risk-based company health levels.

In the implementation of procurement of goods and services, the company is guided by Decree number SK-085/PNM-DIR/VIII/23 and pays attention to general principles. Guidelines for the Implementation of Procurement of Goods and Services are implemented to create uniformity in carrying out the overall procurement process of goods/services in the company in accordance with the basic principles of procurement at PNM by implementing efficiency, effectiveness, transparency, competition, fairness and reasonableness, accountability and immediately prioritizing the use of domestic production.

The purpose and objective of the goods/services procurement guidelines are to increase efficiency in the process at PNM, increase independence, accountability and professionalism, align procurement objectives with the achievement of Company objectives, realize procurement that produces value for money in a flexible and innovative manner but remains competitive, transparent, accountable based on good procurement ethics, increase the use of domestic products and the role of national business actors, micro, small and medium enterprises, optimize integrated information technology, and increase synergy between BUMN, Subsidiaries and/or BUMN affiliated companies.

Procurement of Goods/Services includes goods that can be carried out in an integrated manner, construction work, consulting services that can be carried out through self-management, e-catalog, and/or selection of providers and other services.

.

.

In order to implement SNI ISO 37001:2016 concerning the Anti-Bribery Management System to create a clean and integrated company and support efforts to prevent bribery, the Board of Commissioners, the Sharia Supervisory Board and the Board of Directors of PT Permodalan Nasional Madani have signed the commitment statement in September 2025. All levels of Commissioners, Directors and the Sharia Supervisory Board are committed to implementing everything stated in and related to the anti-bribery policy

SNI ISO 37001:2016 Anti-Bribery Management System (SMAP) is a standard that outlines the requirements and guidelines for companies in preventing, detecting, and handling bribery in the company. All PNM personnel and management consistently implement the values related to the SMAP, namely by always conducting business above the value of integrity guided by the code of ethics and the principle of 4 (four) No's, namely:

- No Bribery (no bribery and extortion);

- No Kickback (no commission, no thanks in the form of money or any other form);

- No Gift (no gifts or gratuities that conflict with applicable rules and regulations);

- No Luxurious Hospitality (no excessive receptions and banquets)

Continuously strive to improve and enhance the Anti-Bribery Management System in every business process to align with the principles of GCG, the Code of Conduct, and the company's business ethics. Implement a zero-tolerance principle against actions related to violations of laws and regulations. Do not allow PNM personnel and company stakeholders to violate the code of ethics and the 4 (four) No's principles related to their duties in the company.

Avoiding conflicts of interest and managing any conflicts of interest that pose a risk of fraud. Instructing and directing PNM personnel and stakeholders to always apply the 4 (four) No's principle and build a Company business with integrity. Supervising the implementation of the SMAP commitment and any violation will be subject to sanctions in accordance with company regulations and applicable laws. All levels of management and PNM personnel are also committed to complying with and implementing the SMAP Commitment earnestly.

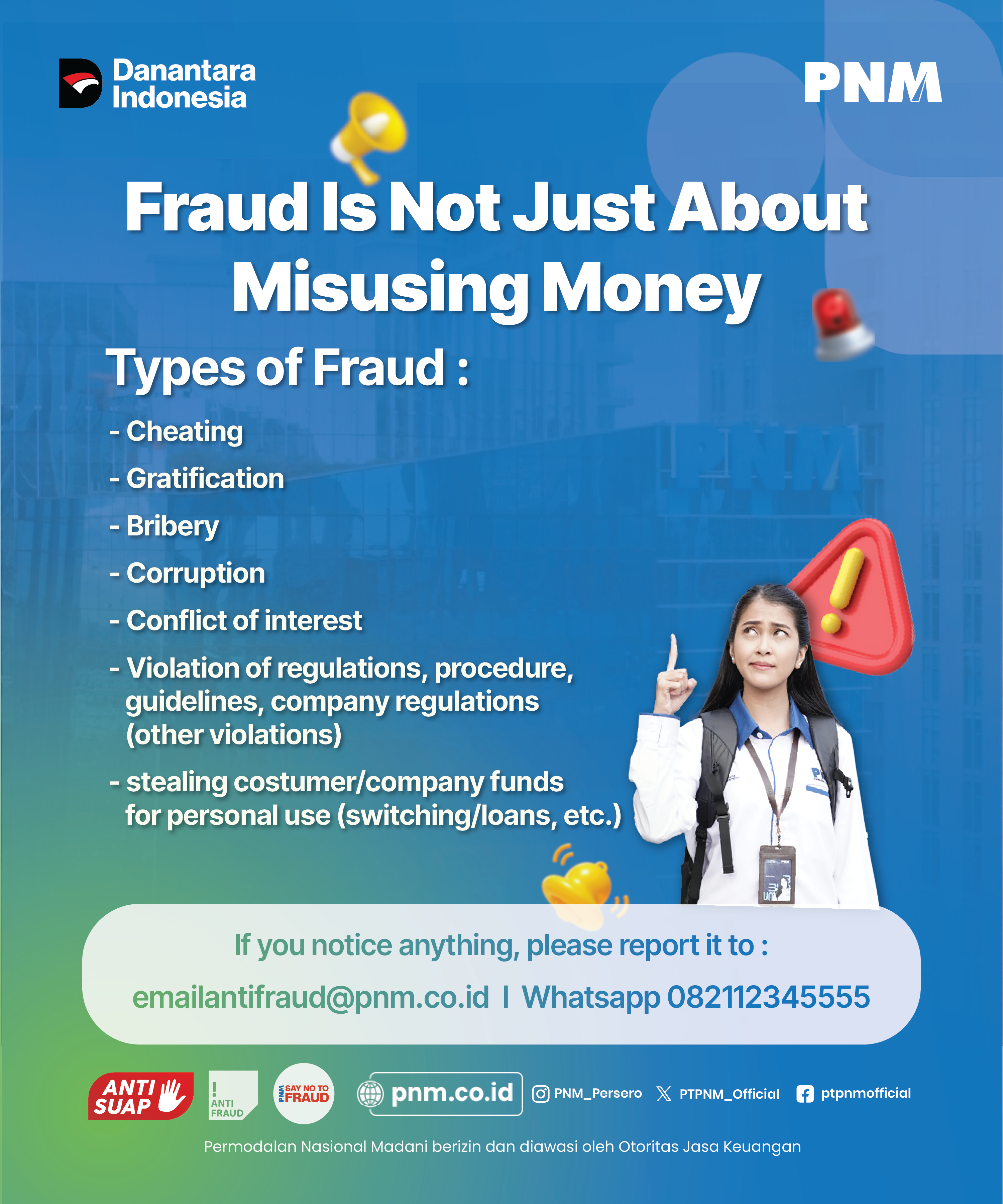

PNM has zero tolerance for any form of fraud. PNM personnel are PROHIBITED from committing the following acts:

- Corruption: accepting/requesting compensation and/or misappropriating company funds for personal gain

- Fraud: The act of deceiving and/or falsifying documents, signatures and all authentic evidence.

- Theft: The act of taking company assets or data that is not the company's right.

- Negligence: Consciously and intentionally ignoring procedural obligations or responsibilities as an employee

- Violation: Acts of violation or breaking into with/without technology including engineering of financial reports.

Don't hesitate to report fraud!

Email: antifraud@pnm.co.id

Whatsapp : 0821 1234 5555

In order to implement SNI ISO 37001:2016 concerning the Anti-Bribery Management System to create a clean and integrated company and support efforts to prevent bribery, the Board of Commissioners, the Sharia Supervisory Board and the Board of Directors of PT Permodalan Nasional Madani have signed the commitment statement in September 2025. All levels of Commissioners, Directors and the Sharia Supervisory Board are committed to implementing everything stated in and related to the anti-bribery policy.

SNI ISO 37001:2016 Anti-Bribery Management System (SMAP) is a standard that outlines the requirements and guidelines for companies in preventing, detecting, and handling bribery in the company. All PNM personnel and management consistently implement the values related to the SMAP, namely by always conducting business above the value of integrity guided by the code of ethics and the principle of 4 (four) No's, namely:

- No Bribery (no bribery and extortion);

- No Kickback (no commission, no thanks in the form of money or any other form);

- No Gift (no gifts or gratuities that conflict with applicable rules and regulations);

- No Luxurious Hospitality (no excessive receptions and banquets)

Continuously strive to improve and enhance the Anti-Bribery Management System in every business process to align with the principles of GCG, the Code of Conduct, and the company's business ethics. Implement a zero-tolerance principle against actions related to violations of laws and regulations. Do not allow PNM personnel and company stakeholders to violate the code of ethics and the 4 (four) No's principles related to their duties in the company.

Avoiding conflicts of interest and managing any conflicts of interest that pose a risk of fraud. Instructing and directing PNM personnel and stakeholders to always apply the 4 (four) No's principle and build a Company business with integrity. Supervising the implementation of the SMAP commitment and any violation will be subject to sanctions in accordance with company regulations and applicable laws. All levels of management and PNM personnel are also committed to complying with and implementing the SMAP Commitment earnestly.

PNM recognizes the importance of implementing Good Corporate Governance (GCG) principles as a means of enhancing shareholder and stakeholder trust. PNM management, in addition to complying with applicable laws and regulations, must also uphold ethical business conduct and values to enhance the Company's reputation and image.

The Code of Conduct is a set of ethical standards for PNM employees designed to influence, shape, regulate, and ensure appropriate behavior, resulting in consistent output aligned with the company's cultural values and the pursuit of its vision and mission. Achieving this goal requires a strong commitment from PNM employees, as outlined in the Code of Conduct.

In order to adapt to the dynamics of PNM's business, the Code of Conduct has been updated, taking into account the applicable rules and regulations, PNM's Vision, Mission, Goals and Values. The company continues to encourage PNM employees' compliance with this code of conduct by requiring all leaders to ensure that the Code of Conduct is adhered to and properly implemented by every PNM employee in the work unit under their leadership.

PNM is committed to implementing GCG practices transparently and with integrity in maintaining stakeholder trust and providing the best service to customers. In carrying out this commitment, PNM provides a means to report any indication of violations that occur within the PNM environment through the PNM Whistleblowing System. The Whistleblowing System is a system that manages violation complaints that allows anyone to report suspected acts of fraud, violations of law, ethics, and the Company's code of conduct committed by Company Employees that could be detrimental to the company. As a form of protection for the Reporter, PNM guarantees the confidentiality of personal data and the contents of the submitted report. PNM always prioritizes confidentiality and the principle of presumption of innocence in following up on every complaint or report submitted. However, if the Reporter cannot complete the required information, the Complaint Report will not be forwarded to the next process.

In running a business that generally involves many parties, it is very important to establish cooperation and relationships that are sustainable and in accordance with the principles of good corporate governance.

One common occurrence in business relationships within companies is the request or offering of gratuities from one party to another. Gratuities are a concern for the Corruption Eradication Commission (KPK) given their nature, which can lead to the crime of bribery.

For this reason, PT Permodalan Nasional Madani has created guidelines that regulate gratuities as a form of preventive and protective effort for all PNM employees.

Statement on Anti-Money Laundering, Counter-Terrorism Financing, and Counter-Proliferation of Weapons of Mass Destruction (AML, CFT, and PPPSPM)

PNM is committed to implementing Anti-Money Laundering, Prevention of Terrorism Financing, and Prevention of the Financing of the Proliferation of Weapons of Mass Destruction (APU, PPT, and PPPSPM) in line with and in accordance with:

- Law No. 8 of 2010 concerning the Prevention and Eradication of Money Laundering Crimes,

- Law No. 9 of 2013 concerning the Prevention and Eradication of Criminal Acts of Terrorist Financing,

- OJK Circular Letter Number 29/SEOJK.01/2019 concerning Amendments to OJK Circular Letter Number 38/SEOJK.01/2017 concerning Guidelines for Immediate Blocking of Customer Funds in the Financial Services Sector Whose Identities Are Listed on the List of Suspected Terrorists and Terrorist Organizations, and

- OJK Circular Letter Number 31/SEOJK.01/2019 concerning Guidelines for Immediate Blocking of Customer Funds in the Financial Services Sector Whose Identities Are Listed in the List of Funding for the Proliferation of Weapons of Mass Destruction.

- OJK Regulation No. 8 of 2023 dated June 14, 2023 concerning the Implementation of Anti-Money Laundering Programs, Prevention of Terrorism Financing, and Prevention of Financing of the Proliferation of Weapons of Mass Destruction in the Financial Services Sector,

PNM's AML, PPT, and PPPSPM policies and procedures have been approved by the Board of Directors and the Board of Commissioners. These policies and procedures are in effect at both the Head Office and all PNM branches. The AML, PPT, and PPPSPM policies and procedures include:

- Periodic reporting on the implementation of APU, PPT, and PPPSPM to the Board of Directors and Board of Commissioners.

- Appointment of Officers Responsible for APU, PPT, and PPPSPM.

- Identification and assessment of the risk level of the implementation of APU, PPT, and PPPSPM at PNM through a risk-based approach by taking into account factors related to customers, countries or geographic areas, products and services, and distribution networks.

- Policy in conducting business relations with potential customers.

- Customer Due Diligence (CDD) relates to customer identification, verification, and monitoring.

- Enhanced Due Diligence (EDD) for the acceptance of Politically Exposed Persons (PEPs) and High Risk Customers.

- Rejection of Transactions and Closure of Business Relationships and Preventive Measures ( Countermeasures )

- Management Information System

- Customer monitoring and follow-up of watchlists issued by the competent authorities, including the List of Suspected Terrorists and Terrorist Organizations (DTTOT) and the List of Funding for the Proliferation of Weapons of Mass Destruction (DPPSPM).

- Updating customer data as a follow-up to monitoring.

- Internal Control and Supervision

- Training and socialization of AML and PPT policies and procedures for employees on an ongoing basis through face-to-face meetings, online classes, and e-learning.

- Know Your Employee(KYE).

- Implementation of APU, PPT, and PPPSPM at Branch Offices in collaboration with the Head Office.

- Administration of customer documents and supporting documents for a minimum of 5 years since the business relationship ended.

- Reporting of TPPU, TPPT and/or PPSPM risk assessment documents, Policies and Procedures, Data Update Plan Reports, Data Update Realization Reports, Copies of DTTOT and DPPSPM Reports to the Financial Services Authority (OJK)

- Reporting of Suspicious Transaction Reports (LTKM)/ Suspicious Transaction Reports (STR) of the Financial Transaction Reports and Analysis Center (PPATK).

- AML, CFT, and PPPSPM sanctions

- Anti-Tipping Off.

The implementation of APU, PPT, and PPPSPM at PNM will be audited periodically by the Financial Services Authority (OJK) as another financial services institution, the PNM Internal Auditor, and the Financial Transaction Reports and Analysis Center (PPATK).

In order to carry out the duties of the Audit Committee, guidelines are required to serve as a basis for the Audit Committee in carrying out its duties. These guidelines for carrying out the duties of the Audit Committee need to be regulated and established in a charter.

Audit Committee Composition

| Year | : 2013 |

| Decree Number | : SK-005/PNM-KOM/VI/2013 |

| Head | : Meidyah Indreswari |

| Member | : Abu Bakr |

| Member: | : Hendro Sasongko |

| Year | : 2018 |

| Decree Number | : SK-002/PNM-KOM/V/2018 |

| Head | : Meidyah Indreswari |

| Member | : Hari Setiadi |

| Member: | : Rafi Rakhmadan |

| Year | : 2020 |

| Decree Number | : SK-005/PNM-KOM/XI/2020 |

| Head | : Meidyah Indreswari |

| Member | : Edy Karim |

| Member: | : Yudha Praja Kusumah |

| Year | : 2022 |

| Decree Number | : SK-007/PNM-KOM/IX/2022 |

| Head | : Meidyah Indreswari |

| Member | : Edy Karim |

| Member: | : Arief Maulana |

| Year | : 2023 |

| Decree Number | : SK-005/PNM-KOM/V/2023 |

| Head | : Iwan Taufiq Purwanto |

| Member | : Edy Karim |

| Member: | : Arief Maulana |

| Year | : 2023 |

| Decree Number | : SK-012/PNM-KOM/XI/2023 |

| Head | : Nurhaida |

| Vice Chairman | : Iwan Taufiq Purwanto |

| Member | : Edy Karim |

| Member: | : Arief Maulana |

| Year | : 2024 |

| Decree Number | : SK-007/PNM-KOM/III/2024 |

| Head | : Nurhaida |

| Member | : Edy Karim |

| Member: | : Arief Maulana |

Audit Committee Charter

Download Report.

In order to support the effectiveness and independence of the Internal Audit Unit (SPI)'s duties, the President Commissioner and President Director of PT Permodalan Nasional Madani have ratified the Internal Audit Charter. The objectives, authorities, responsibilities, and functions of the SPI have been formally defined in the form of an updated PNM Internal Audit Charter - December 2024 and an Integrated PNM Internal Audit Charter - December 2024, which have been signed by the PNM Board of Commissioners and Directors.

As part of the implementation of Good Corporate Governance (GCG), the Internal Audit Unit (SPI) of PNM has a very crucial role in supporting strategic business objectives through effective assurance and consulting activities. In order to help the company achieve its goals, the SPI uses a systematic and disciplined approach to evaluate and improve the effectiveness of risk management, control and governance systems to protect the company's organization and reputation. As regulated in POJK No. 16 / POJK.05 / 2019 concerning Supervision of PT Permodalan Nasional Madani, among others, states that the company is obliged to apply the principles of good corporate governance in all its business activities at all levels and levels of the organization. Therefore, an Internal Audit Charter is needed to ensure the adequacy of the effectiveness of internal controls in the Company in achieving the Conglomerate's vision and compliance with regulations.

The PNM Internal Audit Charter and the Integrated PNM Audit Charter are designed to strengthen and implement synergy, control, and good supervision between the Internal Audit Unit (SPI) and the auditee entity to achieve the company's objectives. There are audit values and standards in the SPI, as a guideline for the SPI to carry out the internal audit function, encouraging the company to have a reliable internal audit function so that it can become a business partner in supporting the company's objectives. In addition, it also serves as a foundation for carrying out activities providing adequate assurance and consulting services to provide added value and improve the internal recognition process, risk management, and sustainable integrated governance within the company.

In accordance with Law Number 40 of 2007 concerning Limited Liability Companies and Law Number 19 of 2003 concerning State-Owned Enterprises and Regulation of the Minister of State-Owned Enterprises Number PER-01/MBU/2011 concerning the Implementation of Good Corporate Governance in State-Owned Enterprises, including POJK number 16/POJK.05/2019 concerning Supervision of PT PNM and the Company's Deed of Establishment (Articles of Association) Number 1 PNM implements corporate governance in accordance with applicable guidelines. In carrying out its operations, PNM implements corporate governance in accordance with the guidelines set out in using SK-125/PNM-DIR/XI/23 with reference to PER-2/MBU/03/2023 concerning Guidelines for Governance and Significant Corporate Activities of State-Owned Enterprises ( Code of Corporate Governance ).

The principles of Good Corporate Governance (GCG) are the rules, norms, or company guidelines required in a healthy state-owned enterprise management system and need to be further optimized to improve company performance. The purpose of this implementation is to optimize the company's value so that it has strong competitiveness both nationally and internationally so that it can maintain its existence and live sustainably to achieve the company's aims and objectives. Encourage professional, efficient, and effective company management, as well as empower the functions and increase the independence of company organs. Encourage company organs to make decisions and carry out actions based on high moral values and compliance with laws and regulations as well as awareness of the company's social responsibility towards stakeholders and environmental sustainability around the company. At the same time, increase the company's contribution to the national economy and improve a conducive climate for the development of national investment.

The GCG principles implemented by PNM include transparency, accountability, responsibility, independence, and fairness. Therefore, all aspects related to shareholders, stakeholders, the Board of Commissioners, the Sharia Supervisory Board, the Board of Directors, related Divisions, and Subsidiaries and Affiliates also refer to the Governance principles contained in SK-125/PNM-DIR/XI/23 with reference to PER-2/MBU/03/2023 concerning Guidelines for Governance and Significant Corporate Activities of State-Owned Enterprises. Likewise, other elements that support the implementation of good corporate governance.

The Corporate Governance Guidelines (in this case, PNM) came into effect on August 23, 2019, and assign the Risk Management and GCG Division, the Corporate Secretariat Division, and the Internal Audit Unit Division responsibility for their implementation. This includes updates/improvements, as needed, to reflect company developments.

• Securities Rating Agency (Pefindo )

Indonesian Securities Rating Agency (PEFINDO)

Address: Sudirman Central Business District (SCBD) Lot.9 Jl. Jenderal Sudirman Kav.52-53 Jakarta 12190

• Trustee

1. PT Bank Mega Tbk

Address: Bank Mega Tower, 16th Floor, Kapten Tendean 12-14A, Jakarta 12790

2. PT Bank Syariah Indonesia Tbk

Address: The Tower Building, 11th Floor, Jl. Gatot Subroto No. 27, Karet Semanggi Subdistrict, Setiabudi District, South Jakarta

3. PT Bank KB Bukopin Tbk:

KB Bank Building, Jl. MT Haryono Kav. 50-51, South Jakarta

• Securities Administration Bureau

PT Indonesian Central Securities Depository

Address: Indonesia Stock Exchange Building, Tower 1, 5th Floor, Jl. Jend. Sudirman Kav. 52-53, Jakarta 12190 Indonesia